A Look at the Upfronts

Marketers know that the annual upfront ad negotiations are no small shakes. Roughly $20 billion of advertising time is parceled out each year between programmers, networks, streaming services and advertisers. Of course, much of these negotiations involve guesswork. “We’re selling a futures market now,” said Jon Steinlauf, chief US advertising sales officer at Warner Bros. Discovery. “It’s hard to imagine what the country’s going to look like in August of 2023, in 15 or 16 months, but that’s really what we’re selling.” Given inflation, a stock market in turmoil, and Russia’s war with Ukraine, many marketers have been more conservative with their spending. Yet lucrative surprises still abounded. Let’s take a look.

Spotlight on the Fun

This year’s upfronts took place in person for the first time in three years, after two years of Covid restrictions. Thousands of ad buyers packed into various Manhattan venues, including Madison Square Garden, Carnegie Hall and Radio City Music Hall. Jimmy Kimmel performed his annual roast—a tradition since 2003—at New York’s Pier 36, though his monologue was delivered via Zoom, due to a positive Covid test. Among other humorous jabs, Kimmel poked fun at Netflix, which has been struggling through a financial slump and plans to introduce an ad-supported model by the end of 2022. “Remember when Netflix openly encouraged us to share passwords, and we were like, ‘How do these people make money?’” said Kimmel at the Disney upfront. “Turns out, they don’t.” Ad buyers were also treated to elaborate musical numbers, including Lizzo revving up the audience with her lyrics “feeling good as hell” during YouTube’s inaugural upfront presentation. Celebrities including Sylvester Stallone and Dwayne “the Rock” Johnson likewise made appearances, along with Khloe and Kris Kardashian, Seth Meyers and football’s Manning brothers.

Streaming Steals the Show

Upfront streaming spend has come a long way since 2019, when advertisers dedicated roughly 10 percent of total budgets to those platforms. This year, the amount was closer to 50 percent, according media buyers. At Disney’s presentation, the lion’s share of trailers and teasers were for movies and series set to premiere on both Hulu and Disney Plus, which will also incorporate advertising later this year. Peacock, Paramount Plus, HBO Max, Discovery Plus, Tubi and Pluto likewise received considerable attention. “Traditionally, the upfronts are for the TV networks,” said Allan Thygesen, who handles Google advertising. “But today, because of the incredible shifts we’ve seen in the media industry, this isn’t your parents’ upfront.” It therefore follows that connected TV (CTV) ad revenues are projected to climb 35 percent to over $6 billion this year, before rising an additional 35 percent to over $8 billion in 2023, according to eMarketer. That includes all ad deals made at the IAB NewFronts, the upfronts and other related events. Meaning that for the first time ever, CTV will total two-thirds of upfront digital video advertising spending in 2022.

Thanks to those power positions, streaming giants were able to ask for higher CPMs (cost per one thousand viewers) at the 2022 upfronts. Warner Bros. Discovery, for example, raised its asking price by as much as 25 percent. Peacock was perhaps the biggest star of the show. Parent company NBCUniversal called this year’s upfronts “record breaking” and the “highest grossing upfront since Comcast’s acquisition of NBCUniversal” over 10 years ago. Much of that success is due to Peacock, the relatively young streamer that increased its upfront revenue from $500 million in 2021 to $1 billion this year, with digital and streaming sales up 20 percent since that time. “Advertising is a futures market, and if the results of this Upfront say anything, it’s that we have built the future our partners want,” said Linda Yaccarino, chairman of global advertising & partnerships.

TV Holds its Own

TV upfront ad spending totaled over $19 billion for the 2022-23 season, with the two strongest sectors comprising pharmaceutical and travel at an increase of 40 percent and 30 percent, respectively. Travel advertisers were especially eager to again start reaching consumers in a post-pandemic world. Retail, fast food, consumer products and tech sectors also enjoyed vigorous buying activity. In general, TV networks fared better than expected, given the current market climate and allowing for the fact that they were willing to accept lower overall rates. Total commitments for NBC primetime were estimated by Variety to land between $3.2 and $3.4 billion, up from a high of $2.98 billion last year. After completing its own upfront sales negotiations, Paramount Global was expected to see ad commitments rise by at least 10 percent for its CBS primetime lineup. That means the network may have secured between $2.23 and $2.9 billion for the 2022-23 television season, up from an estimated high of $2.64 billion in 2021. CBS currently boasts some of television’s most-watched shows, including The Late Show with Stephen Colbert, NCIS, Blue Bloods and The Equalizer, all of which helped drive lucrative ad deals. Other networks, like CW, saw their primetime broadcast programming amass nearly equal volume as last year—between $440 million and $626 million in 2021, compared with $440 million to $597 million in 2022. Still, given the lackluster state of the economy plus Madison Avenue’s concern about the prospect of a national recession, marketers expressed satisfaction with those amounts.

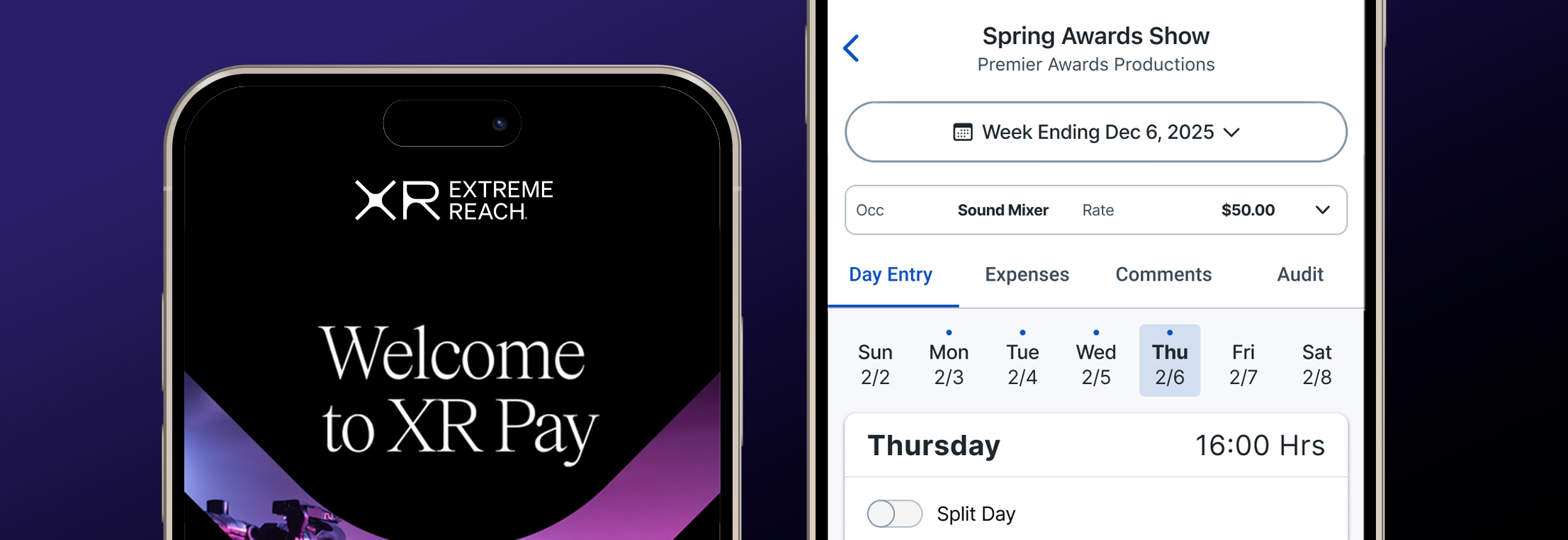

As linear TV and digital video truly converge, brand marketers are challenged by the increasing complexity of managing creative assets and activating omnichannel campaigns. Read more about those challenges and how ER helps brands around the world simplify workflows and ensure campaigns launch on time—every time.

.jpg)